Best Dividend Paying Stocks in India — Full 2025 Investor Guide

Investors looking for stable and consistent returns often search for the Best Dividend Paying Stocks in India, especially during times of market volatility. Dividend-paying companies reward shareholders with regular income, making them ideal for long-term wealth creation. This guide covers top high-dividend stocks, their financial strength, dividend history, yield analysis, and what makes them reliable for 2025 and beyond.

What Makes the Best Dividend Paying Stocks in India?

Dividend-rich companies usually share these traits:

- Strong cash flows

- Consistent profit growth

- Low debt-to-equity

- Large-cap or PSU backing

- Transparent governance

- Long dividend-paying history

Such companies are ideal for conservative investors, retirees, salaried professionals, and anyone building passive income.

Top 10 Best Dividend Paying Stocks in India (2025 List)

Below are India’s most reliable dividend stocks with strong fundamentals and high long-term payout consistency.

1. Coal India – India’s Largest Dividend Giant

Coal India is among the Best Dividend Paying Stocks in India, known for high dividend yield (7–10%) and consistent payouts.

Why it stands out:

- Massive cash reserves

- Monopolistic business

- High government backing

2. ITC Ltd – A Long-Term Compounder + Dividend Star

Known for stable FMCG earnings and cash flow.

Why investors love it:

- 3–5% dividend yield

- Diversified business

- Strong brand ecosystem

3. ONGC – A Reliable PSU Dividend Player

ONGC offers a high yield often ranging between 5–7%.

Benefits:

- Strong petroleum reserves

- Government-supported dividends

- Stable operations

4. Hindustan Zinc – Metal Sector Dividend King

HZL maintains one of the highest payout ratios in India.

Highlights:

- Strong cash flows

- Zero-debt balance sheet

- Massive special dividends historically

You may also like:

5. NTPC – A Long-Term Utility Dividend Leader

Stable earnings and predictable cash flow make NTPC a defensive pick.

Pros:

- 4–5% dividend yield

- Govt backing

- Expanding renewable capacity

6. Power Grid Corporation – Predictable & Steady Dividend Stock

India’s largest transmission utility regularly rewards shareholders.

Key features:

- Highly stable revenue

- Regular dividends every year

- Strong asset base

7. GAIL – Natural Gas Dividend Player

Gas distribution and transmission leader with consistent dividends.

Why consider:

- High volumes

- Strategic government role

- Stable dividend payouts

8. Indian Oil Corporation (IOC)

IOC frequently announces interim dividends.

Positives:

- PSU backing

- Massive retail network

- Attractive yield

9. REC Ltd – High-Yield PSU Financing Company

Popular among dividend income seekers.

Strengths:

- High ROE

- Strong demand for infra loans

- 4–6% average dividend yield

10. Bajaj Auto – High Payout + Premium Brand Power

A rare private-sector stock with massive dividend consistency.

Why it’s loved:

- Zero debt

- Strong export revenue

- High special dividends

How to Select the Best Dividend Paying Stocks in India (In 2025)

To ensure long-term returns, evaluate:

- Dividend Yield (DY)

High yield doesn’t always mean a good stock. Compare DY with industry average.

- Dividend Payout Ratio (DPR)

Ideal range: 30%–70%.

- Profit Stability

Companies with predictable profits offer better dividends.

- Debt Levels

Lower debt = more cash for dividends.

- Long-Term Dividend Track Record

A minimum of 5–10 years is ideal.

Benefits of Investing in the Best Dividend Paying Stocks in India

- Regular passive income

- Hedge against inflation

- Lower portfolio volatility

- Great for retirees and conservative investors

- Builds wealth slowly and steadily

Risks You Should Consider Before Investing

Even the Best Dividend Paying Stocks in India come with risks:

- Government regulation in PSU stocks

- Commodity price fluctuations

- Special dividends may not repeat

- High dividend yield sometimes indicates price fall

Mitigate risks by diversifying across sectors.

Sample Dividend-Focused Portfolio (2025 Edition)

- Coal India – 20%

- ITC – 20%

- NTPC – 15%

- REC – 15%

- Power Grid – 15%

- Bajaj Auto – 15%

This is a sample allocation, not investment advice.

frequently asked questions

Coal India is widely considered the top dividend payer in India due to high yield and regular payouts.

Yes, especially large-cap and PSU dividend stocks, due to stable cash flow and lower volatility.

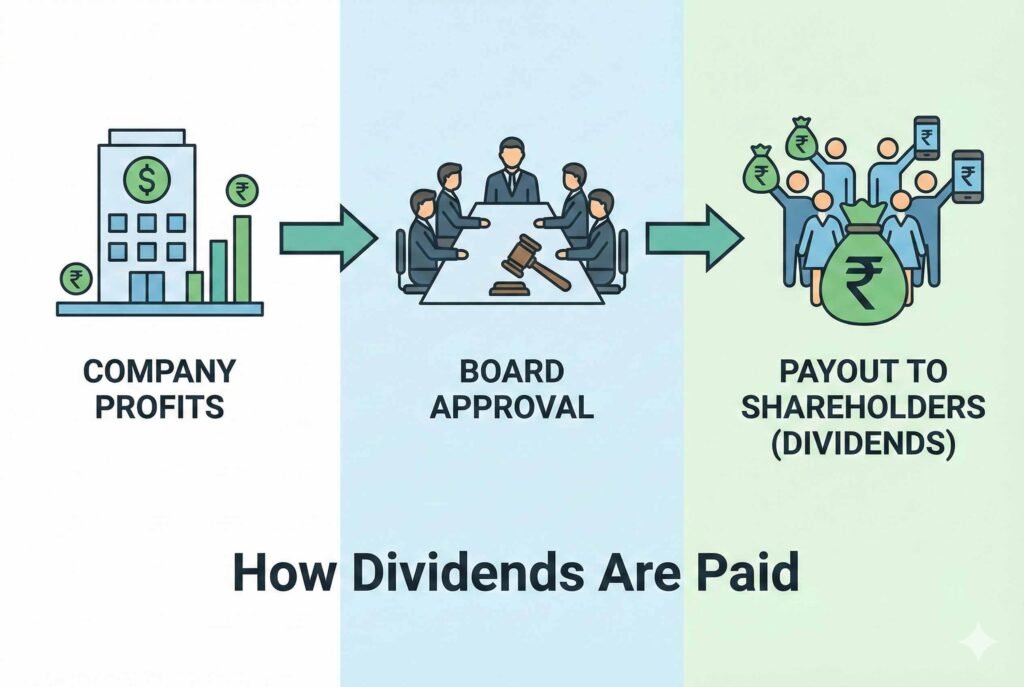

Most pay once or twice a year; some offer special interim dividends.

Dividends are not paid monthly in India, but by diversifying across companies with different payout months, you can build staggered income.

It depends on your goal. Dividends provide income; growth stocks offer capital appreciation.