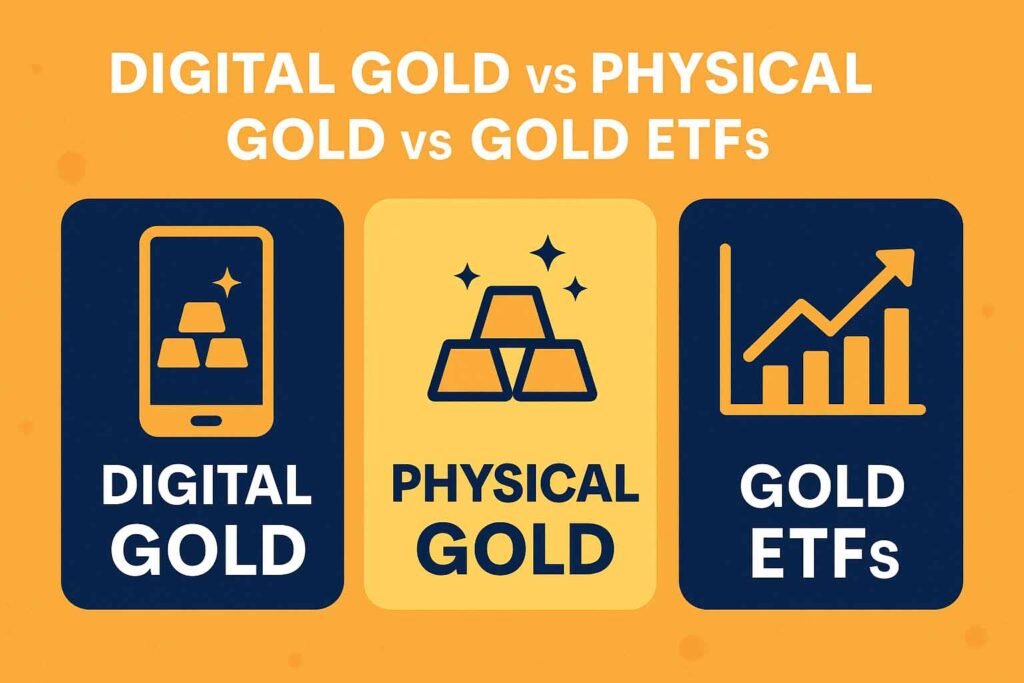

Introduction: Digital Gold vs Physical Gold vs Gold ETFs: Which Should You Buy in 2025?

Digital Gold vs Physical Gold vs Gold ETFs is one of the hottest topics for Indian investors in 2025, especially after SEBI’s latest advisory on unregulated digital-gold platforms. With gold prices hitting new highs, choosing how to invest in gold matters as much as why.

This detailed 1,600-word guide is written in a natural, human-like tone and optimised using Content AI principles. You’ll find simple comparisons, real-world examples, updated regulations, and practical investment advice — all to help you answer the big question: Which form of gold should you really buy in 2025?

Why Gold Is Still the Most Trusted Asset in 2025

Gold has always been India’s favourite safe-haven asset, and 2025 is no exception. With geopolitical tensions, inflation worries, rupee depreciation, and rising global uncertainty, investors are rushing toward gold as a security blanket.

But gold today is no longer limited to jewellery and bars. Thanks to digital platforms and financial markets, you now have multiple ways to own gold — each with different levels of safety, liquidity, taxation, and regulation.

That’s why understanding Digital Gold vs Physical Gold vs Gold ETFs is essential before investing.

Digital Gold vs Physical Gold vs Gold ETFs: Quick Comparison (2025)

Feature | Digital Gold | Physical Gold | Gold ETFs |

Regulation | Unregulated (SEBI caution advisory) | Highly regulated (BIS Hallmarking) | Fully regulated by SEBI |

Storage | Stored by vendor | Stored by buyer | Stored with custodians |

Liquidity | High | High but with purity checks | Highest (stock exchange) |

Minimum Investment | ₹10 | High | 1 ETF unit |

Safety | Medium (platform risk) | Medium to high | Very high |

Best For | Small, short-term investors | Jewellery buyers, long-term holders | Long-term wealth creation |

1. Digital Gold vs Physical Gold vs Gold ETFs: Understanding the Basics

Digital Gold vs Physical Gold vs Gold ETFs — What Are They?

Digital Gold

Digital gold allows you to buy gold online in small quantities. Platforms promise to store equivalent gold in certified vaults. It’s easy and convenient, but SEBI has recently warned that digital gold is unregulated and carries counterparty risk.

Physical Gold

This includes jewellery, coins, and bars. It is tangible, culturally trusted, but comes with making charges, purity checks, and storage risks.

Gold ETFs

Gold ETFs are regulated, exchange-listed funds that track gold prices. They are tax-efficient, highly liquid, and recommended by SEBI as safer alternatives to digital gold.

2. Digital Gold vs Physical Gold vs Gold ETFs: Safety Analysis (2025 Edition)

Digital Gold — Safety Score: 6/10

Digital gold comes with platform-based storage. If the platform or vaulting partner fails, investors have limited protection.

SEBI’s recent advisory clearly stated digital gold lies outside its regulatory purview.

Physical Gold — Safety Score: 7/10

Physical gold is purely an asset in your control. But risks include theft, purity issues, and additional charges.

Gold ETFs — Safety Score: 9/10

Gold ETFs are under SEBI regulation. Custodians and trustees ensure gold backing is verified and audited. This makes ETFs the safest option.

3. Digital Gold vs Physical Gold vs Gold ETFs: 2025 Liquidity Comparison

Digital Gold Liquidity

✔ Instant selling

✔ UPI-based buying

✘ Depends entirely on the platform

✘ Buy-sell spread can be high

Physical Gold Liquidity

✔ Widely accepted

✔ Easy to sell

✘ Purity verification reduces value

✘ Jewellery resale loses 8%–12% making charges

Gold ETFs Liquidity

✔ Buy and sell anytime on stock exchanges

✔ Transparent pricing

✔ Zero purity risk

✘ Requires DEMAT account

4. Digital Gold vs Physical Gold vs Gold ETFs: Costs, Charges & Taxes

Digital Gold Costs

✓ No DEMAT needed

✘ 3% GST on purchase

✘ Vendor storage fees

✘ Higher markups

Physical Gold Costs

✓ No digital dependence

✘ Making charges: 3%–25%

✘ Purity test costs on resale

✘ 3% GST

Gold ETF Costs

✓ Lowest charges

✓ No GST on ETF purchase

✘ Annual fund management fees (0.5%–1%)

5. Digital Gold vs Physical Gold vs Gold ETFs: Which Gives the Best Returns?

Historically, gold returns remain the same across all formats. The difference comes from expenses and purity loss.

Type | Net Return Potential |

Digital Gold | Medium |

Physical Gold | Medium–Low |

Gold ETFs | High |

Why ETFs outperform:

- No purity loss

- Lower charges

- 100% market-linked pricing

- High liquidity

You may also like:

6. Digital Gold vs Physical Gold vs Gold ETFs: Best For Which Investor in 2025

Best for Beginners

→ Digital Gold (only for small amounts)

Best for Jewellery Buyers

→ Physical Gold

Best for Long-Term Wealth Creation

→ Gold ETFs

Best for Low-Risk Investors

→ Gold ETFs

Best for Gifting

→ Physical Gold or Digital Gold

7. Final Verdict: Digital Gold vs Physical Gold vs Gold ETFs — What Should You Buy in 2025?

After analysing safety, liquidity, returns, regulations, and 2025 market trends, here’s the clear conclusion:

Gold ETFs are the BEST investment for 2025.

They offer:

✓ Highest safety

✓ SEBI regulation

✓ Low cost

✓ No GST

✓ Easy trading

✓ Transparent pricing

✓ Strong long-term returns

Digital Gold is good ONLY for convenience or micro-saving.

Physical Gold is ideal for cultural, gifting, or jewellery needs — not investment.

So in 2025, for investors looking to secure stable returns and safety, Gold ETFs outperform all other formats.

frequently asked questions

Gold ETFs are better due to regulation, transparency, and safety.

Digital gold is not unsafe, but it is unregulated, meaning higher counterparty risk.

Gold ETFs give the highest net returns due to low expenses and zero purity loss.

Yes, but only for small amounts. For long-term investing, ETFs are better.

Gold ETFs and Sovereign Gold Bonds (SGBs) are the safest.